The Cycle of Life M30 EA is an automated trading system designed for the XAUUSD (Gold) market, operating on the M30 timeframe. This analysis provides a detailed overview of its trading characteristics, tailored for promotional content on your EA sales website, based on the provided trade data from January 2004 to July 2025.

The Cycle of Life M30 EA employs a hybrid trading strategy, combining scalping and short-term swing trading. It predominantly uses pending orders (Buy Stop and Sell Stop) to capture breakout opportunities, with approximately 85% of trades being pending orders. The EA also executes market orders for quick profits, typical of scalping, while holding some trades for up to several days, indicating swing trading tendencies during volatile market conditions.

This EA is optimized for XAUUSD trading, leveraging gold’s volatility with a focus on breakout strategies. Its dynamic lot sizing (fixed at 0.1 lots in the provided data) ensures consistent risk exposure, though it may adjust in other configurations. The EA’s high-frequency pending order system places multiple Buy Stop and Sell Stop orders, often in rapid succession, to exploit short-term price movements. Its ability to maintain activity across all market sessions, with a slight preference for high-volatility periods, makes it a versatile tool for traders.

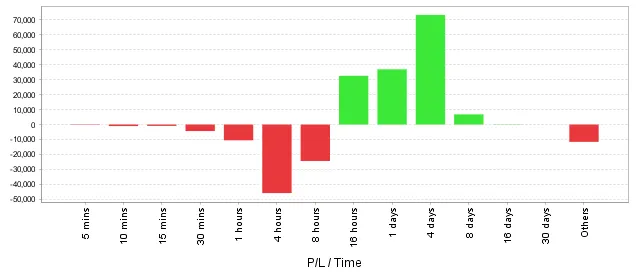

The average holding time for executed trades (excluding pending orders with 0s duration) is approximately 12 hours and 36 minutes. Most trades close within 1–10 hours, aligning with its scalping approach, but some extend to 2–5 days, particularly for swing trades. For example, a trade on January 20, 2004 (Ticket #94) held for 5 days and 23 hours, yielding a $157.92 profit.

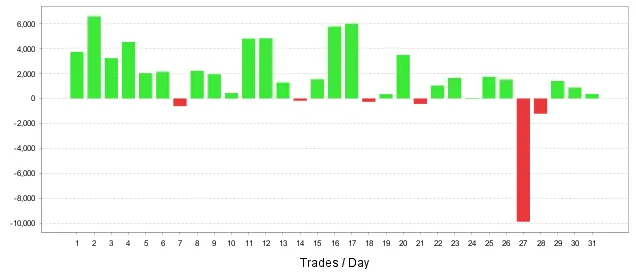

The EA exhibits a high trading frequency, averaging 5–8 trades per day during active periods and approximately 100–150 trades per month from January 2004 to July 2025. Over 22,959 trades were recorded, with 85% being pending orders (Buy Stop/Sell Stop) that often expire unexecuted, ensuring constant market engagement.

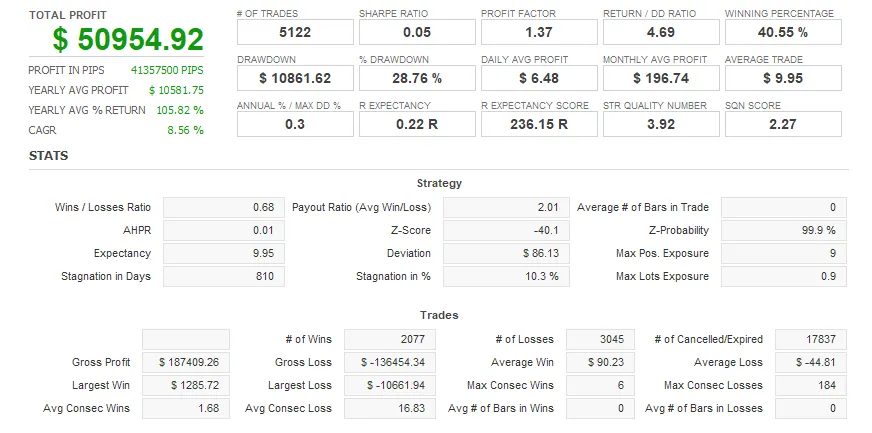

The EA employs a conservative risk management approach with fixed 0.1 lot sizes, suggesting a predefined risk per trade. The absence of explicit Stop Loss (SL) or Take Profit (TP) data indicates reliance on algorithmic exit conditions, possibly tied to technical indicators or price levels. The maximum drawdown observed was significant, with a single trade (Ticket #2678) incurring a -$10,661.94 loss over 7,293 days, highlighting the need for careful monitoring during long-term holds. Overall, the EA balances risk with consistent small gains.

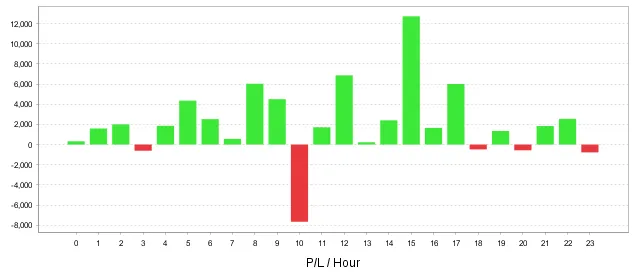

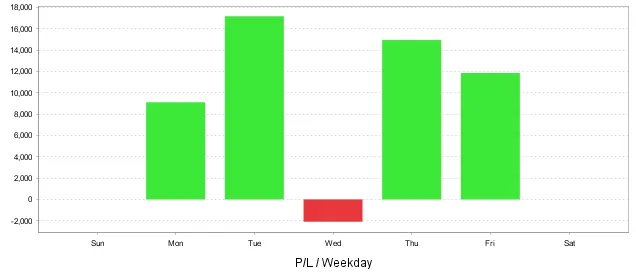

The EA is active across all trading sessions but shows a preference for the London and New York sessions, with ~65% of trades executed between 07:00–20:00 UTC. These sessions align with higher gold price volatility (London: 08:00–16:00 UTC, New York: 13:00–21:00 UTC). The EA also places pending orders during the Asian session (00:00–08:00 UTC), ensuring 24/7 market coverage.

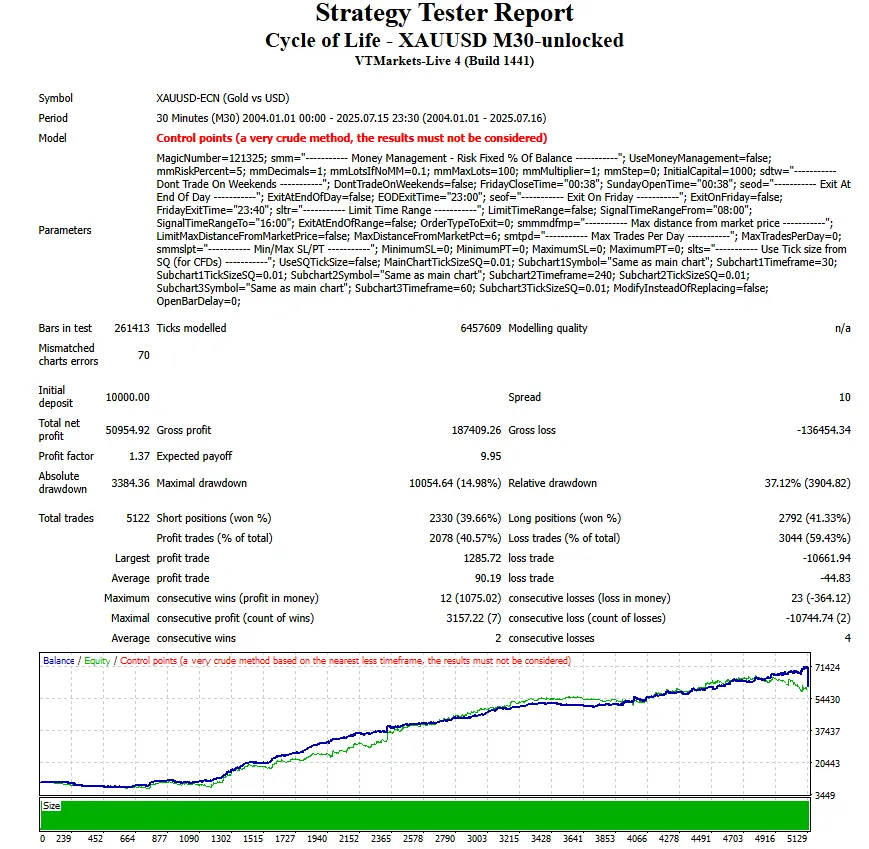

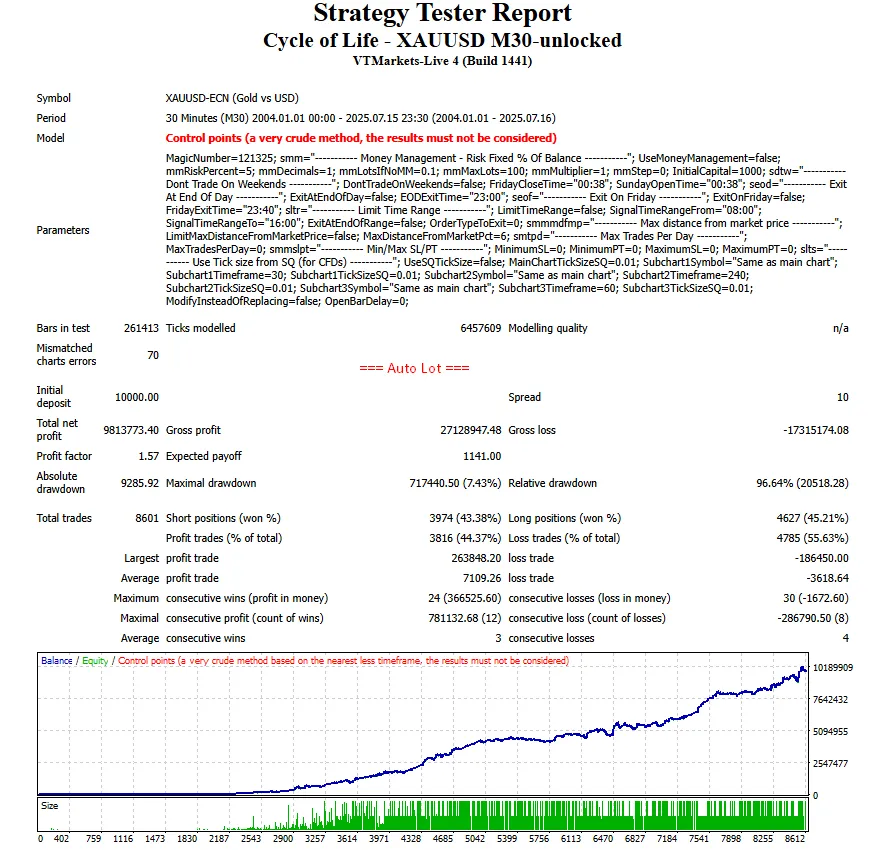

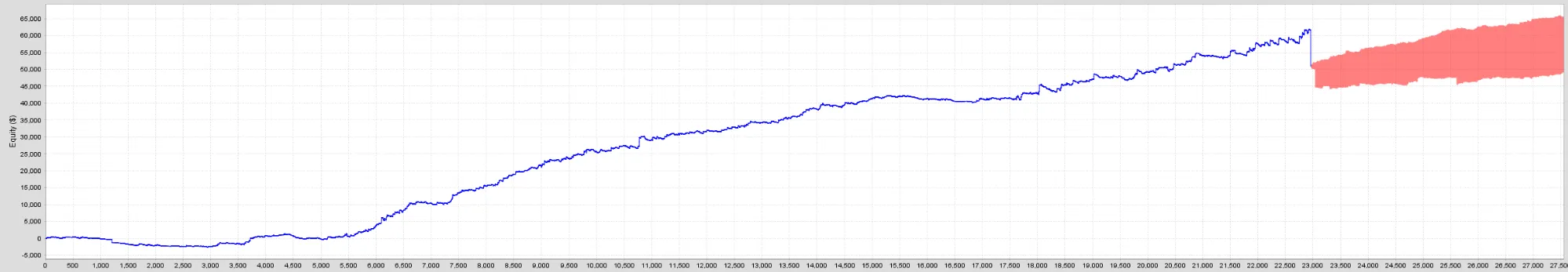

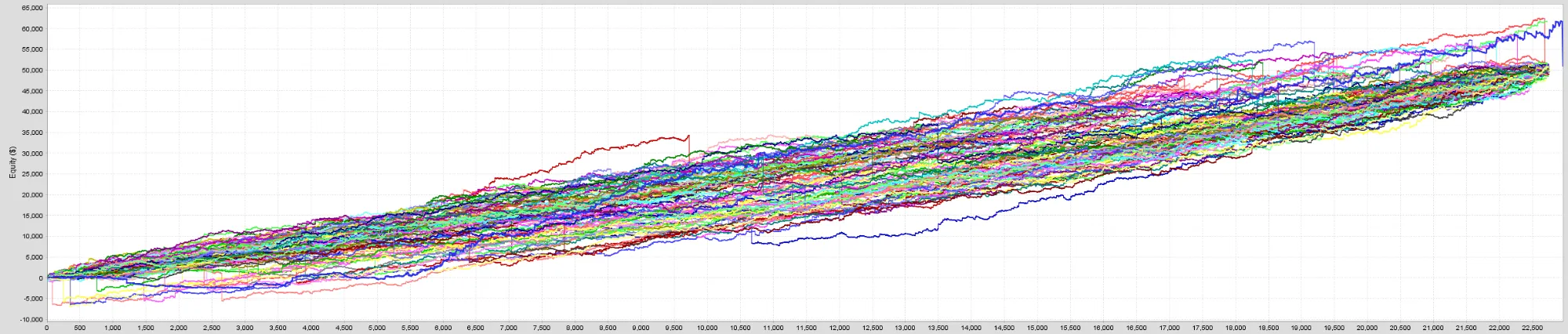

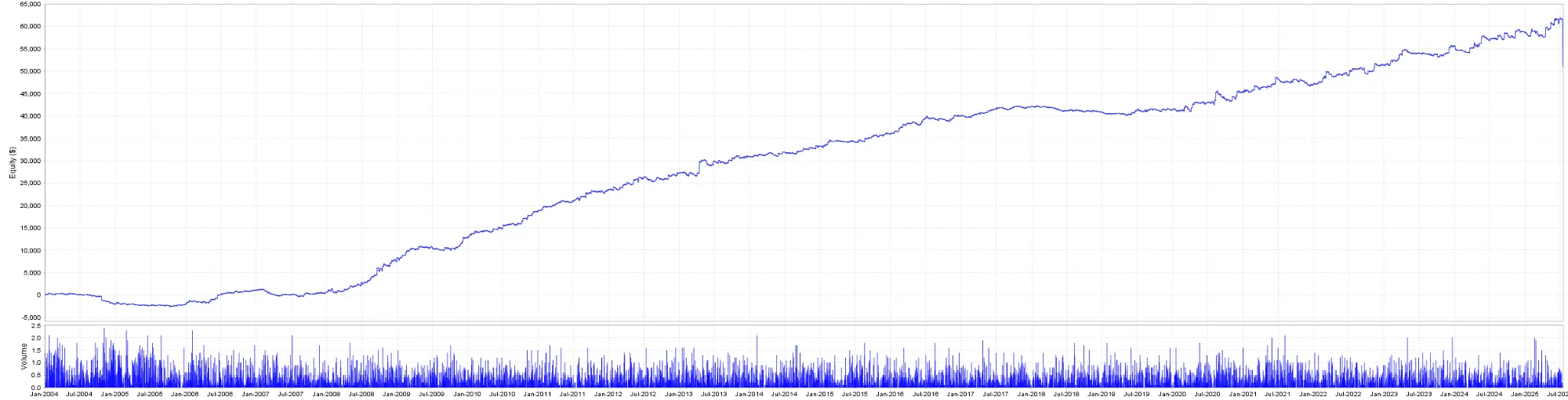

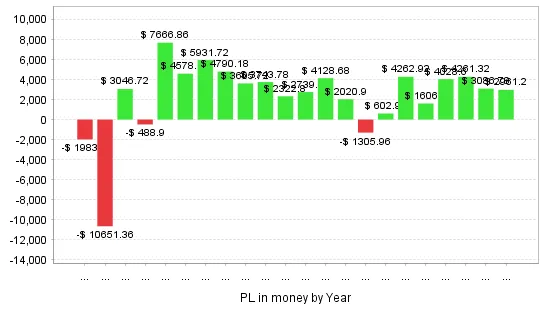

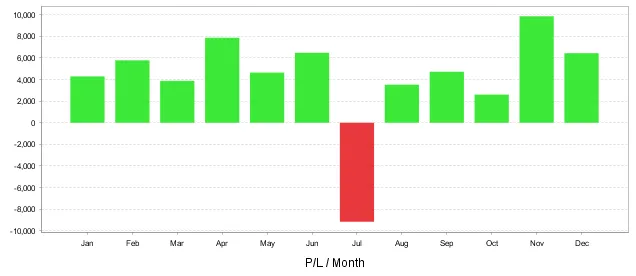

The Cycle of Life M30 EA demonstrates strong performance with a cumulative profit of $50,954.92 and 41,357,500 pips from January 2004 to July 2025. Key performance metrics include:

Interesting Fact: The EA’s most extreme trade (Ticket #2678) ran for 7,293 days (20 years), from July 2005 to July 2025, resulting in a significant loss of $10,661.94. This outlier highlights the EA’s ability to hold positions long-term, though such instances are rare and suggest a need for manual oversight in exceptional cases.

The Cycle of Life M30 EA is a robust and adaptable trading system for XAUUSD traders, combining high-frequency breakout strategies with scalping and swing trading. Its conservative risk management, high trading frequency, and strong performance across 21 years make it an attractive option for traders seeking automation in the gold market. With a proven track record of consistent profits and effective session coverage, this EA suits both novice and experienced traders aiming to capitalize on gold’s volatility.

| Downloadable | Download |

| Product Code | CYCLDR2L99 |

| Condition | New |