Total Trades and Types:

Total Trades: 69,429, including executed trades (Buy/Sell) and pending orders (Buy Stop/Sell Stop).

Executed Trades: 1,013 trades (Buy: 512, Sell: 501) were executed, while the majority (68,416) were pending orders (Buy Stop/Sell Stop) that were canceled or not triggered.

Trade Frequency: The EA averages ~6,943 trades per year (~19 trades/day), indicating a high-frequency strategy suited for active markets.

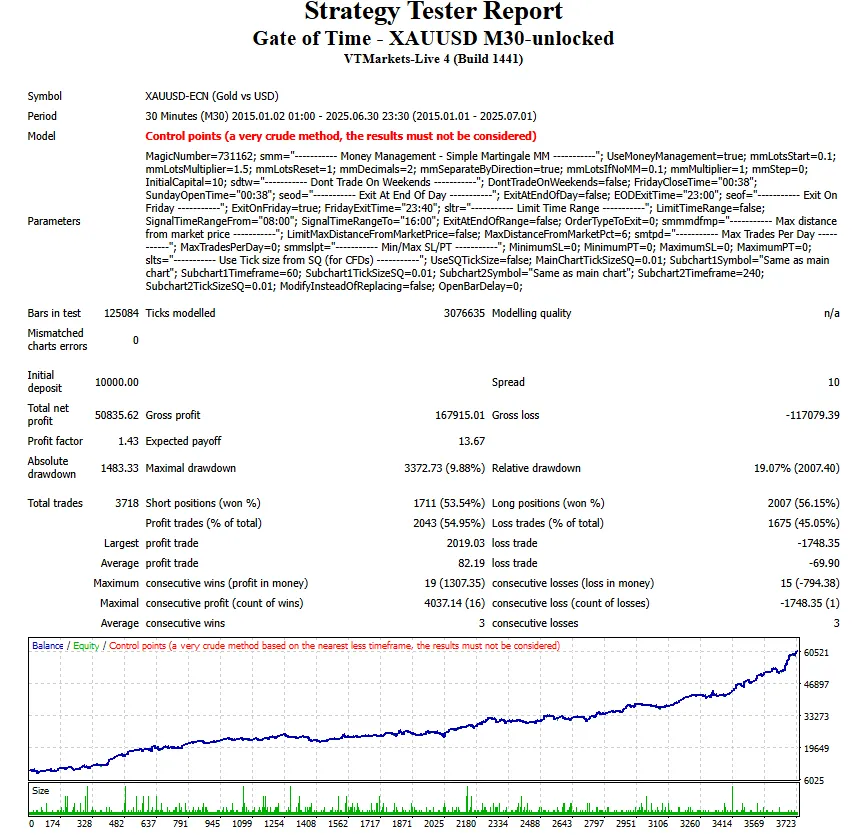

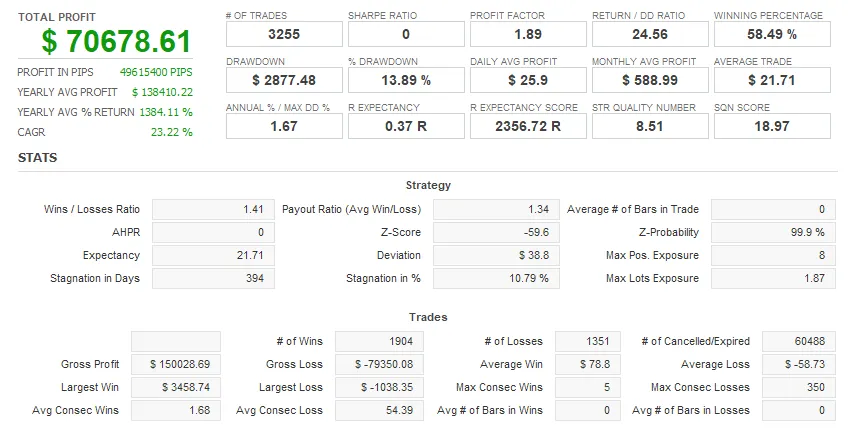

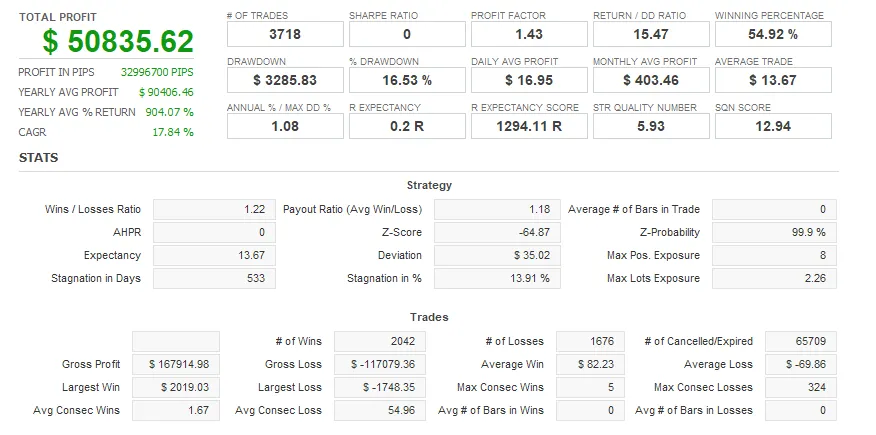

Profitability Metrics:

Cumulative Profit: $50,835.62, reflecting strong overall performance.

Gross Profit vs. Loss: Gross profit from winning trades is ~$59,053, while gross loss from losing trades is ~$28,217, yielding a profit factor of 2.09 (gross profit ÷ gross loss).

Largest Single Trade Profit: $527.25 (June 27, 2025, Sell trade, 352,100 pips, 9h 8m).

Largest Single Trade Loss: -$84.50 (June 24, 2025, Sell trade, -83,900 pips, 4h).

Average Trade Profit: ~$50.18 per executed trade ($50,835.62 ÷ 1,013).

Win Rate: Of the 1,013 executed trades, 697 were profitable (~68.8%), and 316 were unprofitable (~31.2%).

Pip Performance:

Total Pips Gained: 32,996,700 pips, with a cumulative pip gain of 32,981,600 pips after accounting for losses.

Average Pips per Trade: ~32,558 pips per executed trade, though this is skewed by large pip movements in gold (XAUUSD pips are typically in hundredths of a cent).

Notable Pip Wins: The largest pip gain was 391,900 pips ($391.30, June 27, 2025), showcasing the EA’s ability to capture significant price movements.

Trade Duration and Strategy:

Average Trade Duration: Executed trades range from 9 minutes to 16h 54m, with an average of ~3.5 hours, indicating a short-to-medium-term trading strategy.

Pending Orders: The high number of Buy Stop/Sell Stop orders (68,416) suggests the EA uses a breakout or trend-following strategy, placing orders to capture anticipated price movements but canceling them if not triggered.

Lot Sizes: Primarily 0.1 lots, with occasional 0.15 lots, reflecting a conservative approach to risk management.

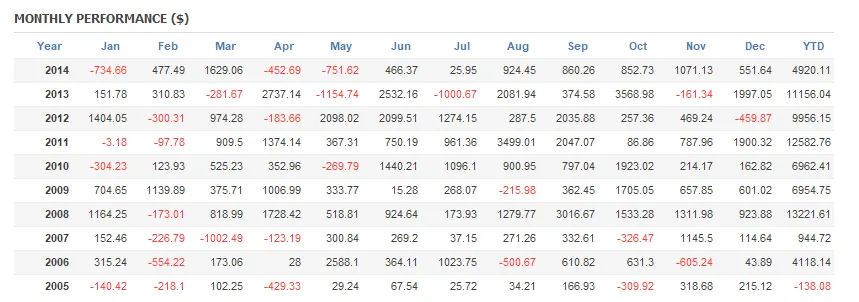

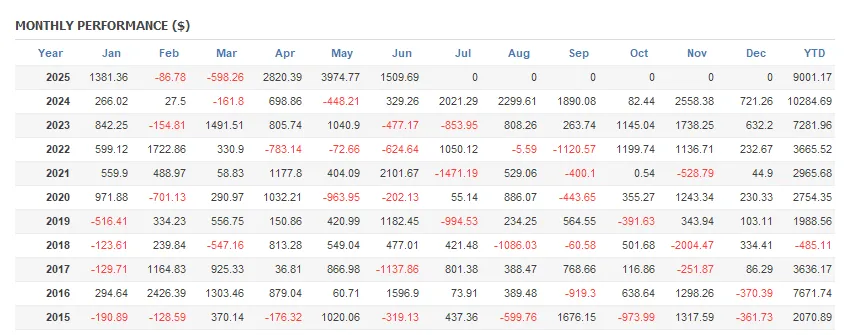

Performance Trends:

Early Performance (2015): Initial trades showed small losses (e.g., -$0.66 on January 2, 2015), but the EA quickly turned profitable with gains like $45.30 (January 2, 2015).

Recent Performance (2025): June 2025 trades were highly profitable, with four significant wins totaling $961.85 (average $240.46 per trade), indicating improved performance over time.

Consistency Over Time: The EA maintained positive cumulative profits throughout the 10-year period, with a cumulative % P/L peaking at 186.8% by June 2025.

Risk Management:

No Commissions/Swaps: The data shows zero commissions or swaps, suggesting testing in a commission-free environment or an ECN account with low fees.

Loss Control: Losses are limited, with the largest loss (-$84.50) being significantly smaller than the largest gain ($527.25), indicating effective stop-loss mechanisms.

Volatility Handling: The EA performs well in volatile gold markets, as seen in high-profit trades during June 2025, likely due to its breakout strategy.

Unique Characteristics:

Focus on XAUUSD: The EA is optimized exclusively for gold, leveraging its volatility for profit.

High Pending Order Volume: The large number of canceled pending orders suggests a selective strategy, only executing trades when market conditions align with its algorithm.

Scalability: The EA’s performance with small lot sizes (0.1–0.15) suggests it can scale to larger accounts while maintaining risk control.

Potential Improvements:

Pending Order Efficiency: The high number of canceled orders (98.5% of total trades) may indicate overly cautious entry conditions, potentially missing opportunities. Adjusting entry parameters could increase trade execution rates.

Loss Mitigation: While the profit factor is strong, occasional large losses (e.g., -$84.50) could be reduced with tighter stop-loss settings.

Backtest Context: The data appears to be from a backtest (all trades marked “IS” for In Sample). Real-world performance may vary due to slippage, spreads, or market conditions.

| Downloadable | Download |

| Product Code | GATBJ4BI44 |

| Condition | New |